Benefits of PSI for Manufacturing Industries

Maharashtra is considered to be one of the biggest contributors to the Indian economy. To ensure a conducive industrial climate in the state and facilitate sustainable growth of industries, the government of Maharashtra has been continually introducing and amending industrial policies to assist MSME and Small Scale industries. Package Scheme of Incentives is one such policy. The latest of which was amended back September 2019 and will remain in operation till 2024.

The incentives of the scheme are in the form of exemptions or refunds from taxes, reliefs related to electricity duties, reduction in stamp duty, and others.

What is PSI Scheme?

Package scheme of incentives is a state-wise policy that was introduced in order to promote the development of industries, encourage investments, inventions, improve employment rate, and ensure growth.

The scheme differs from state to state and is directly governed by the Directorate of Industrial Policy and Promotions. The construction of the policy and the various features depends upon the state and its condition. The policies are generally for a period of 5 years. The PSI scheme has been prevalent in the state of Maharashtra from as early as 1964.

Who can avail these benefits?

Subsidies and waivers are available for MSME industries and small-scale industries with fixed capital investments of up to Rs.50 crore. These are the industries listed in the First Schedule of the Industries, manufacturing companies as per the MSMED Act, IT manufacturing units and food/agro Processing Units among others.

The benefits are available for existing and new units. Existing units are the units that have started production before 1st April 2019, have an eligibility certificate (EC) and have filed an application under PSI 2013.

To qualify as new units, there should not be an existing unit, one effective step must be completed before April 2019, and there is no reconstruction, demerger or change in ownership.

Benefits available for fixed capital investment and business expansion cost

The benefits can be availed for fixed capital investment as well as for business expansion costs.

Fixed capital investment can include investment in land, building an office building and staff quarters, and plant & machinery etc. To qualify for benefits on account of expansion, companies need to invest a minimum amount of investment, increase the existing capacity by a minimum percentage and increase employment etc.

Companies can invest a minimum of Rs.25 lakhs, increase installed capacity by at least 25% etc, increase employment by 10% out of which 80% should be local people, to avail the benefits.

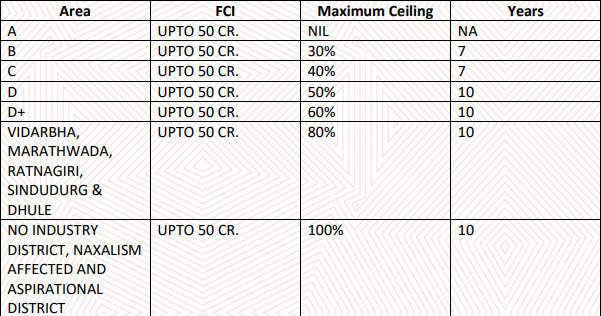

The maximum quantum of benefits and the number of years that companies can avail subsidies will depend on the area of operation. Areas for PSI 2019 are classified into seven categories: Group A, Group B, Group C, Group D, Group D+, no industry districts, Naxalism affected areas & aspirational districts.

Fixed Capital Investment

Here is the breakup on the ceiling on benefits that companies can avail on their fixed investment costs:

Expansion Costs

In the case of expansion and diversification of units, one can claim benefits equivalent to 80% of the benefits that are available for new units. To summarize, here are some of the financial incentives available for companies:

- a) Industrial Promotion Subsidy of 100% of Gross SGST can be availed.

- b) Companies can claim interest subsidy on the interest paid to the bank at an effective interest rate or 5% p.a. whichever is lower.

- c) Companies can get a 100% exemption from electricity duty.

- d) Stamp duty is waived for specified groups.

You can consult your CA to gain clarity and assistance in availing the subsidies, stamp duty waiver, and other exemptions.